Fundraising

Fundraising Built for Alignment, Not Overhead

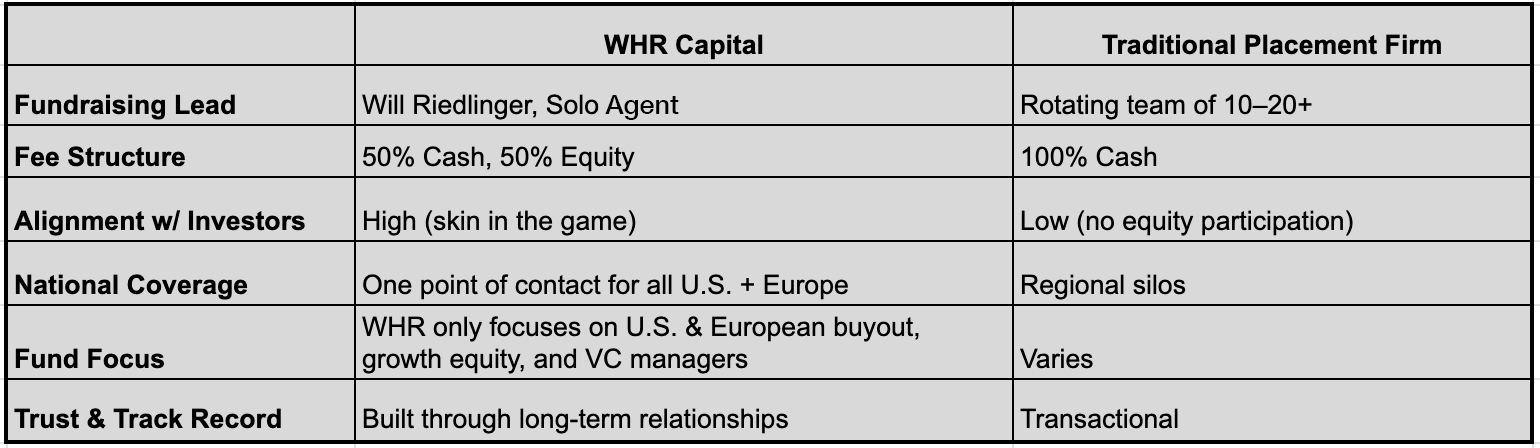

A typical firm raising $200M might charge 2% and the standard placement fee is payable over two years. This means 50% of the LPs management fees go to the placement agent for the first two years of the investment period, at a time when GPs really need those fees to grow junior staff, field back-office operations, and have senior partners pay themselves a salary. WHR Capital runs a different fee stream.

One Person. One Point of Contact. Total Alignment.

Will leads every mandate personally, no handoffs, no bloated teams. That means fewer fees, faster execution, and a fundraising partner who’s fully accountable. But it’s not just about efficiency. It’s about alignment.

WHR's Model: Cash + Equity = Better Results

Let’s say WHR raises $200M for a client.

Standard Fee: $4M (based on 2%)

What Large Firms Do: Take it all in cash, typically over 2 years

What WHR Does:

WHR rolls the other half into equity alongside LPs coming into the fund.

At the final closing, the GP & WHR will calculate aggregate capital raised, WHR will execute subscription documents

When the capital calls come the GP will fill out the capital call on behalf of WHR

When distributions come, WHR receives distributions when LPs receive distributions

This hybrid model reduces immediate overhead for clients while giving Will long-term skin in the game, aligning his outcomes with investor success.

Why It Matters

For the GP: This allows a GP to manage their P&L with a less stringent placement fee as it spread the placement fee out over a number of years

For the LP: Whenever WHR Capital takes on a mandate, you'll know there is a huge about of "skin in the game".